1/22

'Sooner or later we all sit down to a banquet of consequences'

Robert Louis Stevenson

Successive UK governments have for almost four decades been recklessly indifferent to the UK’s persistently low savings and investment, justified by the myth that it is not a priority for a services-led economy and that we can instead rely on continuous access to capital from overseas.

While other factors have been at play, this has left the UK with:

- 15 years of stagnant per capita income (0% growth), a fall of 12 places (to 23rd) in the UK’s global ranking

- an economic growth recipe and fiscal position which is unsustainably reliant on immigration (10+ million gross since 2000)

- an irresponsible dependence on foreign capital, leading to debacles such as Thames Water

A total reorientation of public policy to the rebuilding of the UK’s savings and investment is urgently required.

This will enable us to restore per capita income growth, recover economic competitiveness and national sovereignty, and assure adequate retirement provision for today’s and future generations.

The time to act is now.

2/22

It is a myth that a services-led economy does not require savings and investment – UK savings levels are significantly lower than peers, who are similarly dependent on services

Source: World Bank: Gross savings (% of GDP); Employment in services (% of total employment) (modelled ILO estimate);

3/22

The persistence of this myth paved the way for a succession of bad policies that destroyed the DB pension system, allowing the insurance industry to feast on its remains

‘It’s worse than a crime, it’s a blunder’

Comment in reaction to Napoleon’s execution of the Duc d’Enghien in 1804 by Joseph Fouché or Antoine Boulay de la Meurthe (also often credited to Voltaire)

Source: LCP pensions analysis (17 August 2023); PPF – 2023 Purple Book; L&G press release (19 February 2024); L&G Reporting (page 13) in Introduction to IFRS 17: “Indicatively, writing £10bn of UK PRT per annum will generate around £900m of CSM and RA in that year 1, with an average duration of typically around 12-14 years”; « c’est pire qu’un crime; c’est une faute », 1804, attributable to either Joseph Fouché or Antoine Boulay de la Meurthe. Notes (1) % of open DB funds assumed 100% in 2000, 98% in 2001 and straight lined to 43% in 2006 as per PPF Purple book. Open schemes from 2012 onwards as per TPR (4% of schemes open in 2023). (2) £30bn unrealised profit is the sum of reported Contractual Service Margin (CSM) of the UK’s six largest pension risk transfer insurance companies (L&G, Aviva, Just Group, Phoenix, Rothesay and PIC). £12-15bn realised profit is estimated based upon total pension risk transfers completed in the UK to date – based upon average PRT profitability of 9% CSM and RA per transaction and an average CSM and RA duration of 12-14 years, in line with L&G indications. (3) 2023E as per L&G press release

Notes:

(i) The regulatory burden of operating a pension scheme became so onerous for corporate sponsors that, of the UK’s then 7000 private schemes in 2000, some 95% closed to new members over the next twenty years, which meant the funds then had a finite time horizon and no scope for future replenishment and therefore a correspondingly lower risk appetite. And now that (from 2005) the present value of all future liabilities had to be shown on the face of the balance sheet, with no credit whatsoever for future returns from the assets, corporate sponsors’ sole objective became to eliminate risk, which led Trustees to implement a wholesale change in asset allocation, from over 50% listed UK equities to the present level of around 3% and reinvested instead in low return, low risk, mainly government bonds. This meant that the entire UK pension system became, for the next two decades, a structural seller of UK equities and a structural buyer of gilts at progressively lower yields.

(ii) At the same time, the closed nature of the funds lent itself to an ‘insurance’ solution for in effect the sale of the assets to purchase annuities. In this formulation, ultimate responsibility for the assets and liabilities of the pension funds would, for a transfer fee, be shifted to a life insurance company, which in turn liquidates whatever is left of the equity portfolios and also the gilts, since a buyout’s profit over time is determined by a spread over the yield on gilts. (see Bloomberg article: https://www.bloomberg.com/opinion/articles/2024-03-01/uk-markets-how-might-the-next-gilt-crisis-start-like-this)

(iii) While the insurer is providing a service to the corporate by taking over responsibility for the obligations and removing the liability from its balance sheet, this transfer does not add to pensioners’ income in any way and in fact the service only exists as a result of government policies that made keeping the pension funds open so onerous in the first place, as the graph shows – insurance buyouts only began and accelerated following the introduction of the unfavourable regulations in the mid 2000s. Brokers estimate that the UK life insurance industry makes roughly half of its profits through the assets and liabilities of corporate pension funds being simply transferred from the corporate to the insurer itself.

4/22

Governments then took over a decade to implement a replacement, DC auto-enrol, which is totally inadequate to meet future retirement needs and even more fragmented and underweight UK assets than the existing DB system

5/22

One of the many consequences of the DB system’s destruction has been the collapse of UK equity valuations, with UK companies now at a massive competitive disadvantage, especially raising new capital for growth

Source: Panmure Gordon Research. Note: Chart shows the indexed spread of UK and World ex-UK 3 year rolling averages of blended P/E, P/B and EV/EBITDA multiples

Notes:

(i) The UK market is an extreme outlier in the low level of domestic ownership of its equity market, either in absolute terms or in relation even to the UK’s weighting in global markets. This matters since, absent a reservoir of long term domestic shareholders, the system for raising primary capital has completely broken down, materially inhibiting UK companies’ ability to raise new primary equity. (see Bloomberg article:https://www.bloomberg.com/opinion/articles/2023-10-26/uk-companies-at-hedge-fund-mercy-without-home-support).

(ii) Large international investors typically hold UK investments as part of a global asset allocation, which changes regularly according to their overall strategy, or they are attracted by the low valuations and sell once/if this corrects, very often through a sale to a non UK buyer compelled by the low relative valuations for good businesses, particularly in the smaller company sector. This means a typically shorter investor holding period and a lower appetite for risk. This has also corresponded to a material reduction – around 50% over the past ten years – in daily trading activity on the LSE, further reducing the UK market’s attractiveness.

(iii) The gap between UK valuations essentially tracks (but is not the only factor behind) the liquidation over the past 20 years of listed UK equity holdings by UK pension funds and insurance companies, which also sold their listed UK assets for similar regulatory reasons (more capital charges than accounting).

(iv) It has been argued elsewhere that pension funds and insurance companies have been right to reduce their UK holdings due to the poor performance, but this ignores the massive headwinds that UK face given the disappearance of new primary capital (other than in 2008 and the pandemic), especially for growth, which has shifted the emphasis for shareholders to dividends, making the issuance of new equity also prohibitively expensive and self-fulfilling – over distributing and under investing accounts for much of the UK large companies’ underperformance in terms of capital appreciation.

6/22

UK per capita income has been stagnant for over 15 years. The only period of robust growth was during the Bubble, fuelled by unsustainable leverage

'It is a night of disaster when a man sees the truth'

Bertolt Brecht

Source: World Bank: GDP per capita (current US$); Deposit Money Bank Assets to GDP (%); Brecht, Bertolt, 1943, “Life of Galileo”, Wall Street Journal. Note: (4) Total assets held by deposit money banks as a share of GDP. Assets include claims on domestic real nonfinancial sector which includes central, state and local governments, nonfinancial public enterprises and private sector. Deposit money banks comprise commercial banks and other financial institutions that accept transferable deposits, such as demand deposits

7/22

As a result, the UK’s global per capita income ranking has fallen 12 places, more than any other major country, with the UK now in 23rd place

‘We’re unable to see the face of the mountain while we stand on top of it’

Old Chinese proverb

Source: IMF World Economic Outlook (April 2024): GDP per capita, current prices (U.S. dollars per capita) Note: Similar ranking deltas found using World Bank data

8/22

This dismal per capita growth record cannot be attributed to the UK’s overall taxation levels, which have been consistently lower than our peers (and an unchanged 45% top rate since 2013)

Source: OECD: Tax revenue as a percentage of GDP; Table I.7 Top statutory personal income tax rates, Note: US tax revenue as % of GDP in 2022 was 28%.

9/22

UK Governments’ revealed preference: Tax hikes? Spending cuts? Or higher legal immigration? Without the last decade’s immigration, UK income tax revenues would today be ~£14bn lower

‘David Miles, executive member of the Office for Budget Responsibility (OBR), has warned that a migrant-driven upgrade to the UK’s population may not provide a long-term boost to the public finances’

Source: Nelson, Fraser, 29 February 2024, “The post-Brexit immigration surge was an accident, not a conspiracy”, The Telegraph; ONS: Long term international migration provisional year ending June 2023. Notes: (5) £14bn income tax revenues as a result of immigration is calculated as net immigration between 2012-Jun’23 as a percentage of the current population (5%) multiplied by 2023 income tax revenues of £271bn. (6) Quotation is from 29 February 2024 Telegraph article. David Miles, an executive member of the Office for Budget Responsibility (OBR), said waves of new migrants would not solve Britain’s fiscal crisis and were likely to pile pressure on public services. It comes amid growing expectations that the OBR will hand the Treasury a war chest of up to £23bn for tax cuts when they revise up migration projections in line with official estimates. However, the former Bank of England rate-setter warned that a migrant-driven upgrade to the UK’s population may not provide a long-term boost to the public finances. By contrast, the Imperial College professor said it was “much less clear that persistently high levels of net immigration to boost the labour force can generate sustained fiscal improvements”.

10/22

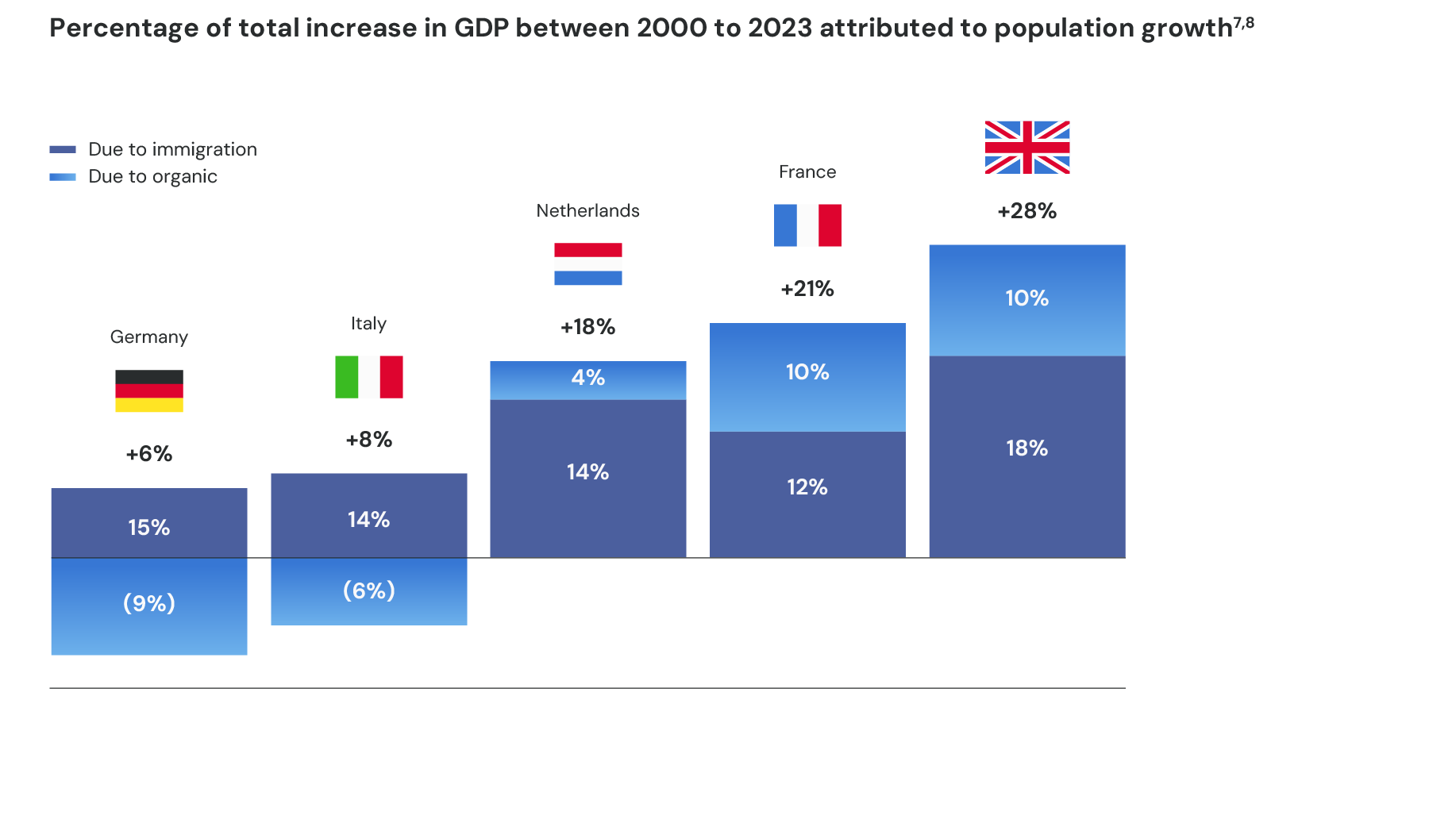

The UK economic growth is more dependent on immigration than any of our major European peers

Source: ONS, U.S. Census Bureau, OECD, Federal Statistical Office of Germany, IMF World Economic Outlook (April 2024): GDP and GDP per capita current prices (U.S. dollars). Notes: (7) Total increase (UK:28%) calculated as % change 2000-2023 GDP (UK:92%) less % change GDP/capita 2000-2023 (UK:66%) as a proportion of GDP change 2000-2023. % change 2000-2023 GDP and GDP per capita are calculated as the change between average 1999-2000 and average 2022-2023. % increase due to net immigration and organic calculated as respective proportions of total population increase over 2000 to latest year available (2021/22). (8) Germany adjusted for the net immigration from Afghanistan, Syria, Iraq and Ukraine

11/22

Dependence on foreign capital has also led to a steady erosion of the UK’s national and economic security, best illustrated by Thames Water

Reservoir of domestic capital is vital to safeguarding critical national assets

Critical infrastructure

- Much of UK’s water, rail and transport industry is owned by foreign capital (e.g. Thames Water, Heathrow Airport)

- Almost all major UK projects entirely reliant on foreign capital (e.g. HS1, wind farms, solar power, toll roads)

Energy security

- Five out of the six main UK energy companies, and all of our gas distribution under foreign ownership

- Nuclear (Sizewell C) half owned by non UK interests with remaining stake previously under Chinese ownership

Technology industries

- DeepMind sale to Google, ARM Holdings sale to SoftBank and subsequent US listing

- Newport Wafer Fab (NWF) owned by Wingtech Technologies (HK)

'Tomorrow's winners'

- Every significant new UK enterprise financed by foreign venture capital, including Graphcore, CMR Surgical and Hopin

- Most of wealth being created by new companies will accrue outside the UK

13/22

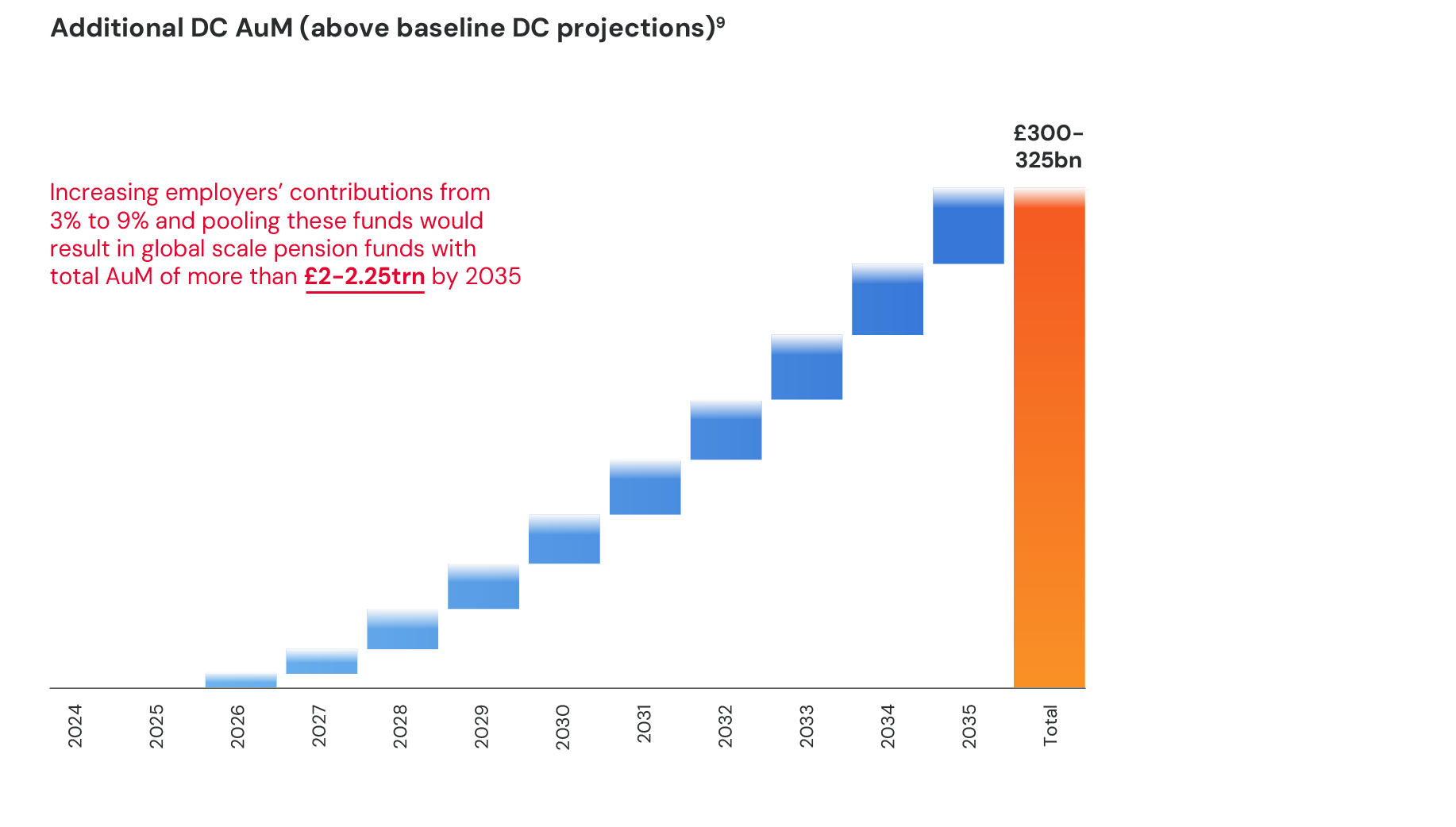

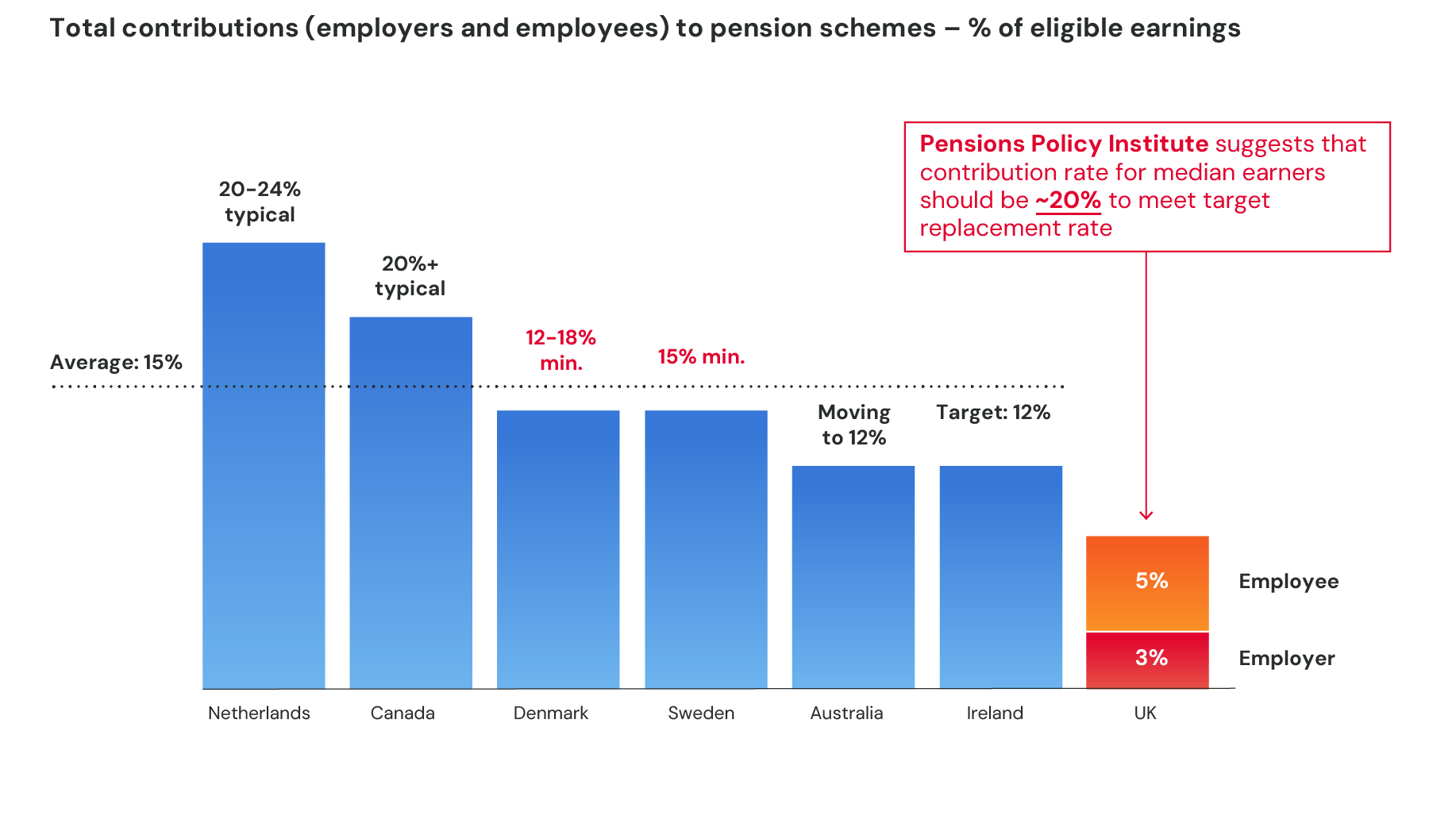

A step change increase in employers’ contribution to DC auto-enrol, while pooling the fragmented schemes (and streaming a portion to invest in UK assets) to enable adequate retirement provision for future generations – a critical first step

Source: ONS: Funded occupational pension schemes in the UK: July 2019 to March 2023: Reference table (21 September 2023). Note: (9) As per TPR, assumes 1% growth in number of employees contributing and 2022 DC AuM of £500bn with investment return of 6% p.a. Minimum AE contribution assumed to increase: 2024 (8%), 2025 (10%), 2026 (12%), 2027 (14%), 2028 (15%), 2029 onwards (16%). Additional DC calculated as 25% multiplied by additional DC contributions at assumed rates less baseline 8% projections

Notes:

(i) This increase would on the face of it represent an extra cost for the businesses paying it. There are however several offsetting factors that distinguish this additional outlay say from a typical tax or cost increase.

(ii) First, the contributions will be paid into a fund that, over time, will generate returns that will in turn fund future benefit payments. For example, a single fund in a single Canadian Province, Ontario Teachers Pension Plan (OTTP) has assets of around C$300 billion and, in a typical year, over 100% of the payments to its pensioners is funded by that year’s investment income and gains. Under the present low levels of DC contributions in the UK, there is no realistic possibility that the investment gains will be anywhere near sufficient to pay future benefits, leaving future pensioners to face poverty in their retirement, in which scenario the cost to remedy will inevitably fall to the taxpayers, which will then be a real cost as opposed to one that is funded by investment gains.

(iii) Second, this cost will ultimately come back to companies and to individuals, who will have to bear this burden through higher levels of taxation – there is no cost free way of addressing this issues, the question is how to minimize the cost, and the obvious answer is by harnessing the power of scale, time horizon and return compounding through a professional managed fund.

(iv) Third, some of the extra contributions will be dedicated to replenishing the pool of capital available for investment in listed UK companies, which can in turn be eventual recipients of more primary capital for growth and a more buoyant domestic capital market, so some of the cost of extra contributions could in fact come back to the companies through long term growth capital.

14/22

Higher DC auto-enrol consolidated and streamed as for 20% into UK corporate assets plus tying UK asset allocation to DB pension funds’ tax privileged status would generate £300bn+ of new productive investment for the UK

Source: ONS: Ownership of UK shares; Funded occupational pension schemes in the UK: January to March 2023; Ownership of UK shares; Funded occupational pension schemes in the UK; Note (10) +£300bn new productive investment estimated as combination of 20% multiplied by £1.4trn of total DB assets as at 31 March 2023 plus 20% of projected DC AuM (vs. £90bn invested today in UK listed firms by UK pension and insurance companies)

15/22

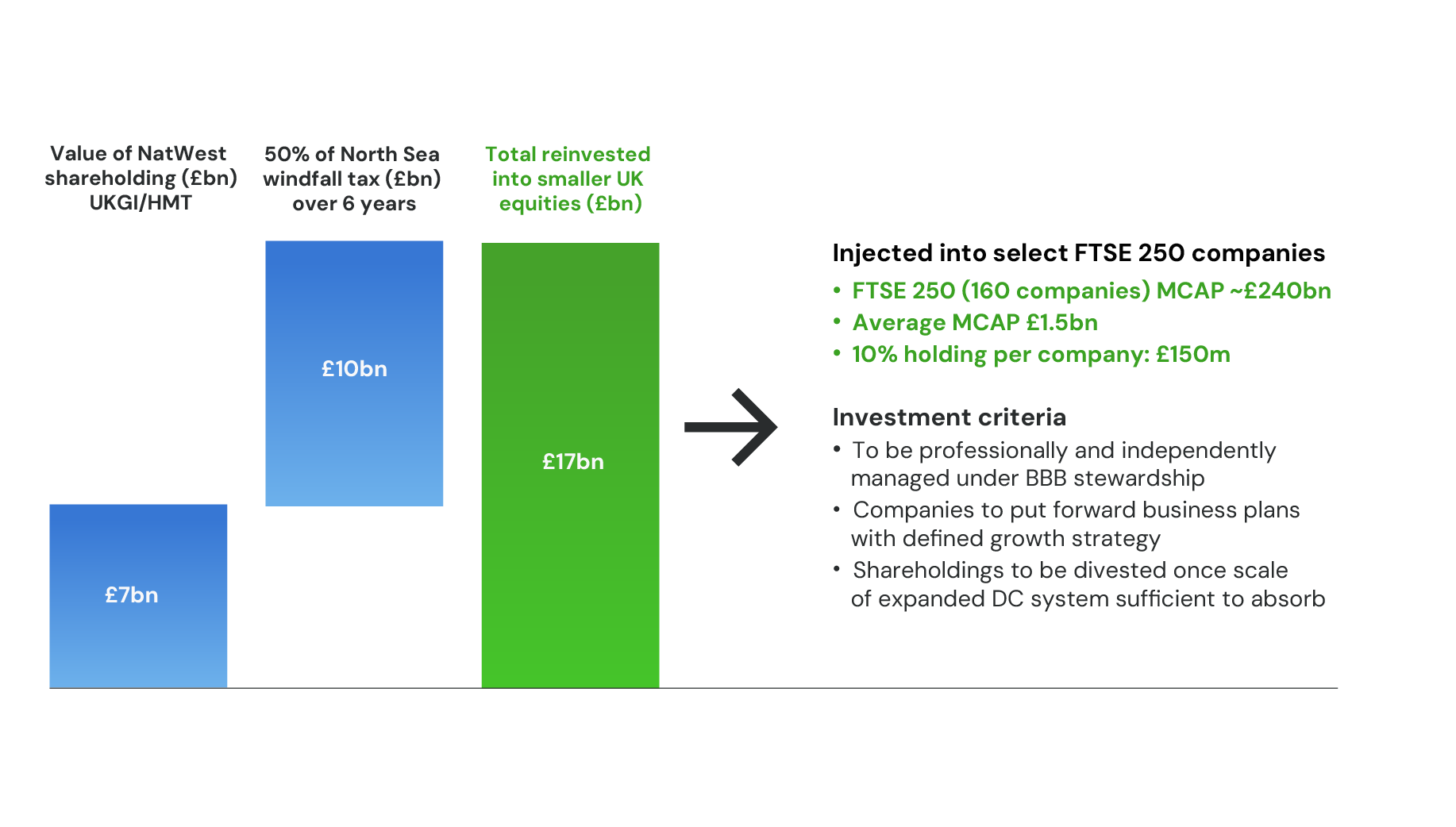

As it will take time to re-build the domestic equity reservoir, a redeployment of NatWest sale proceeds and North Sea windfall tax can serve as a nucleus for a new sovereign wealth fund, providing much needed capital to UK smaller listed companies in the market

Source: Bloomberg, OBR “Economic and fiscal outlook – March 2024”

16/22

The remaining DB pension system cannot be permitted to be liquidated through insurance buyouts, both to preserve UK productive investment and to protect the stability of the gilt market. A windfall tax on excess returns from buyouts is necessary and justified

Source: PIC Investor Presentation 2023 (27 March 2024); L&G press release (19 February 2024); Record breaking global PRT market activity seen in 2023; JP Morgan research (13/11/2023); L&G Reporting (page 13) in Introduction to IFRS 17: “Indicatively, writing £10bn of UK PRT per annum will generate around £900m of CSM and RA in that year 1, with an average duration of typically around 12-14 years”.

Notes: (11) As per JP Morgan research. (12) £30bn unrealised profit is the sum of reported Contractual Service Margin (CSM) of the UK’s six largest pension risk transfer insurance companies (L&G, Aviva, Just Group, Phoenix, Rothesay and PIC). Assuming 8% profits and 35% tax. New business profits of £10bn assumes c.50% cut in brokers’ protections. (13) Assuming 8% profit and 35% tax. New business profits of £10bn assumes +50% cut in projected buy-in & buy-out volumes.”

17/22

Greater incentives for capital investment/R&D would help stimulate investment for the long-term rebalancing of the UK economy, and restore industrial competitiveness

Source: Institute for Fiscal Studies: Composition of UK revenue; Corporation tax explained; IFS TaxLab; HMRC internal manual. HMRC capital allowances manual. Notes: (14) Annual Investment Allowance (in 000’s) £50 (2008-2010), £100 (2010-2012), £25 (2012-2013), £250 (2013-2014), £500 (2014-2015), £200 (2015-2018), increasing to £1m from 2018. (15) Value of tax depreciation on capex calculated as value of year 1 annual deduction of depreciation of capex; 18% declining balance basis from 2012-13 to 2020-21

18/22

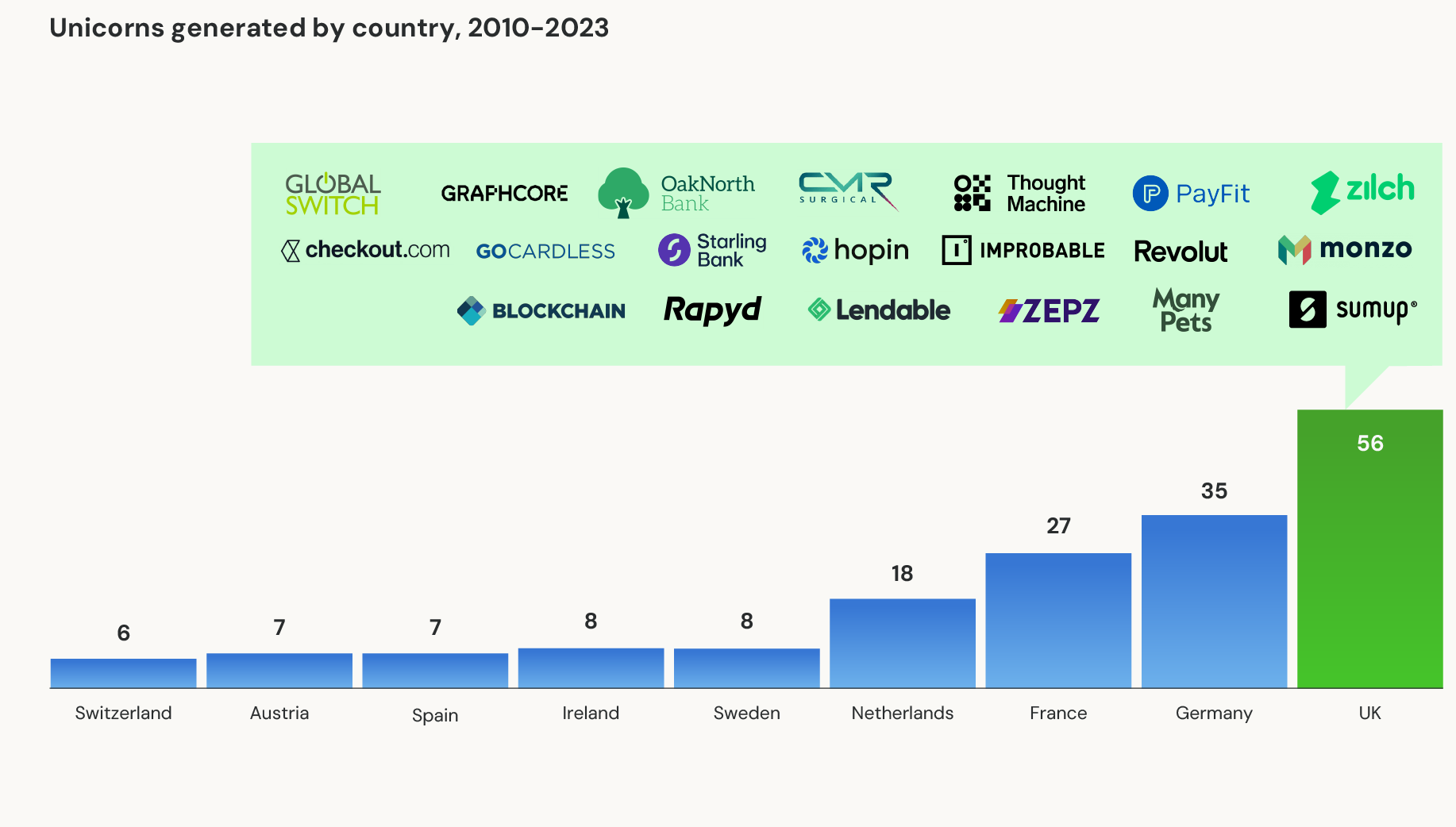

The UK is by far the and away the European leader in the number of private companies valued at >$1bn. However, the wealth and value creation accrues mostly overseas

Source: McKinsey Research: Opportunities in the UK’s Corporate landscape, Selected Exhibits, December 2023, CBInsights (Global Unicorn Club):CBInsights Unicorn Startup market map.

19/22

Enhanced incentives for individuals to start and grow businesses will stimulate growth and keep more of the wealth creation from the UK’s energy and creativity here at home

1

More businesses are started per capita in the UK than in any other European country, in addition to having by far the most ‘Unicorns’ (private businesses valued at least $1 billion)

2

£1m per person lifetime deduction for income tax purposes (or, if insufficient taxable income, a transferable credit as per the US Inflation Reduction Act) for all investments in UK startups or private trading companies with a minimum holding period 3 years (up to 50% may be deductible in any one year)

3

The sale of any such investment would also be exempt from tax on capital gains (currently 10%) and from Inheritance Tax of up to £1m per person per lifetime

4

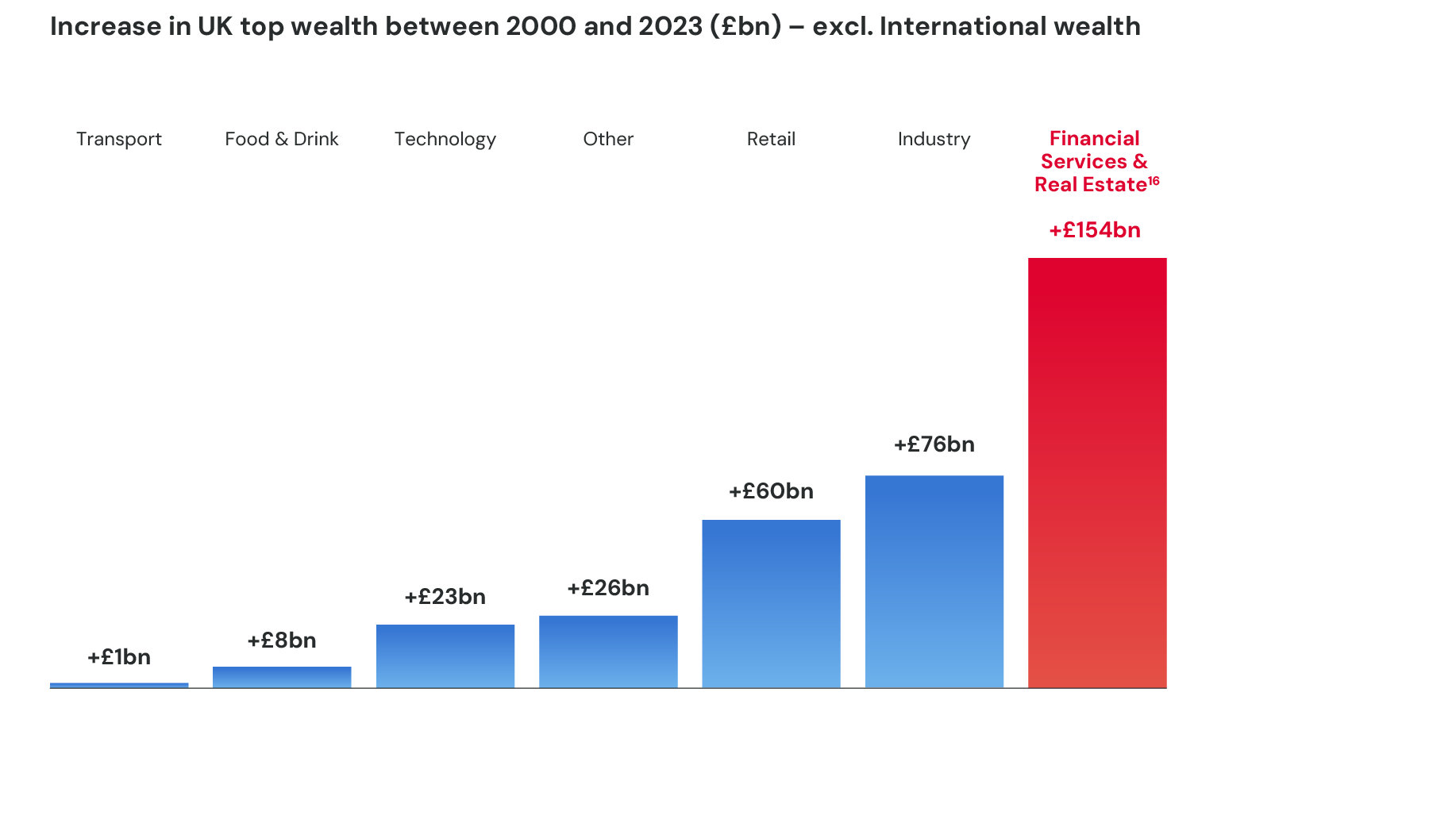

Any business (other than real estate or regulated financial services) would qualify, in line with the overall goal of encouraging both new business creation/replenishment and rebalancing as between industry and financial services

20/22

This will also help restore a better and more diversified balance of wealth creation, which has favoured financial services and real estate

21/22

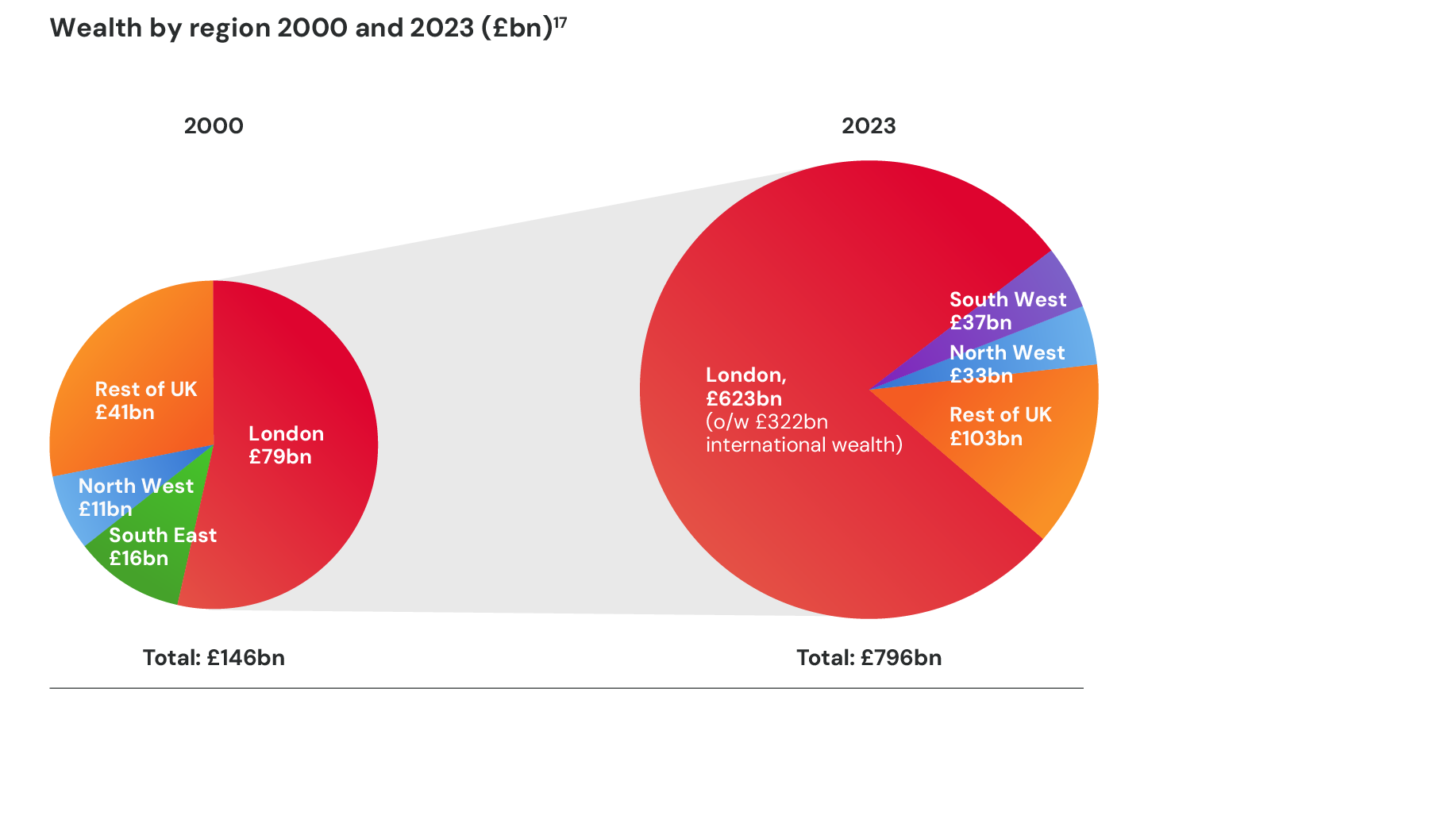

More domestic savings to harness the UK’s abundance of entrepreneurial energy and capacity for innovation will lead to wealth creation which is better aligned with the distribution of talent around the country

22/22

A total reorientation of public policy towards an urgent rebuilding of the savings and investment system that is critical to restoring per capita income growth and our sovereignty

Savings for life

A material increase in the employer’s contribution to DC savings plans to begin both the rebuilding of the savings pool and to provide better retirement security for the next generation, accompanied by an aggregation into a global scale pool

Kickstart

Kickstart a sovereign wealth fund through an immediate injection of new capital into the domestic equity market (from 50% of the North Sea windfall and NatWest sale proceeds) with an initial focus on FTSE350

Refilling the reservoir

Replenishing the reservoir of domestic equity capital by linking DB and DC pension funds’ tax privileges to minimum investment in UK domestic assets (companies and infrastructure)

'Dead money' tax

A new ‘dead money’ tax to protect the remaining DB pension schemes from buyout related liquidation and its consequences for the UK’s domestic equity and gilt markets

Investment for growth

A rebalancing of the tax system between capital investment/R&D and labour to improve productivity and reduce the economy’s dependence on immigration

Entrepreneurs unbound

Unleashing and amplifying entrepreneurial activity through a lifetime allowance of £1m per person deductible from income for tax purposes, up to 50% in one year

Comments

Comment Guidelines

Please keep comments respectful. Use plain English and avoid using phrasing that could be misinterpreted as offensive. By commenting, you agree to abide by our terms and conditions. We encourage you to report inappropriate comments.